FOR BUSINESSES

Grow business fearlessly, supported by cyber insurance for digital risk

Cyber risk moves fast. Meet the first cyber insurance provider to launch Active Insurance designed to prevent digital threats and help keep you in control.

Cyber insurance and security together to protect your business

Traditional insurance can’t keep up with dynamic cyber risk. Coalition’s active approach combines innovative tools and services with deep cyber and insurance experience to deliver:

Ongoing monitoring during the term of the policy

AI-powered security tech built with insights from security experts

Support with trusted partnerships to mitigate incidents

OUR SOLUTION

Take a closer look at how Active Insurance works

Coalition combines technology and cyber insurance to help policyholders experience 64% fewer claims than industry average.*

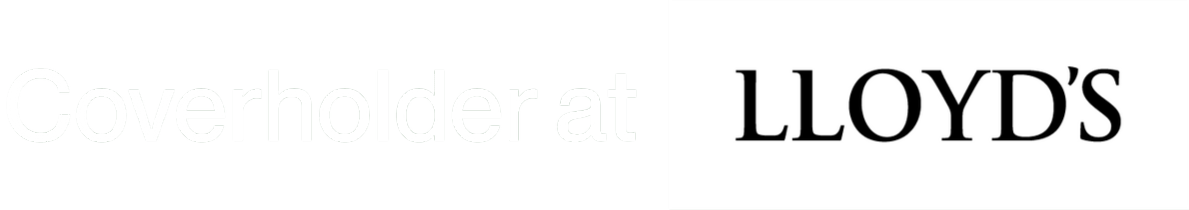

ACTIVE ASSESSMENT

See your business the way a hacker does

✓ Personalised digital risk profile ✓ Comprehensive coverage tailored to your company’s risk ✓ Pricing that’s based on your risk exposure

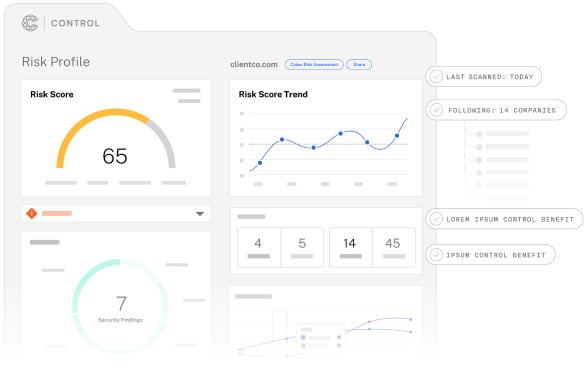

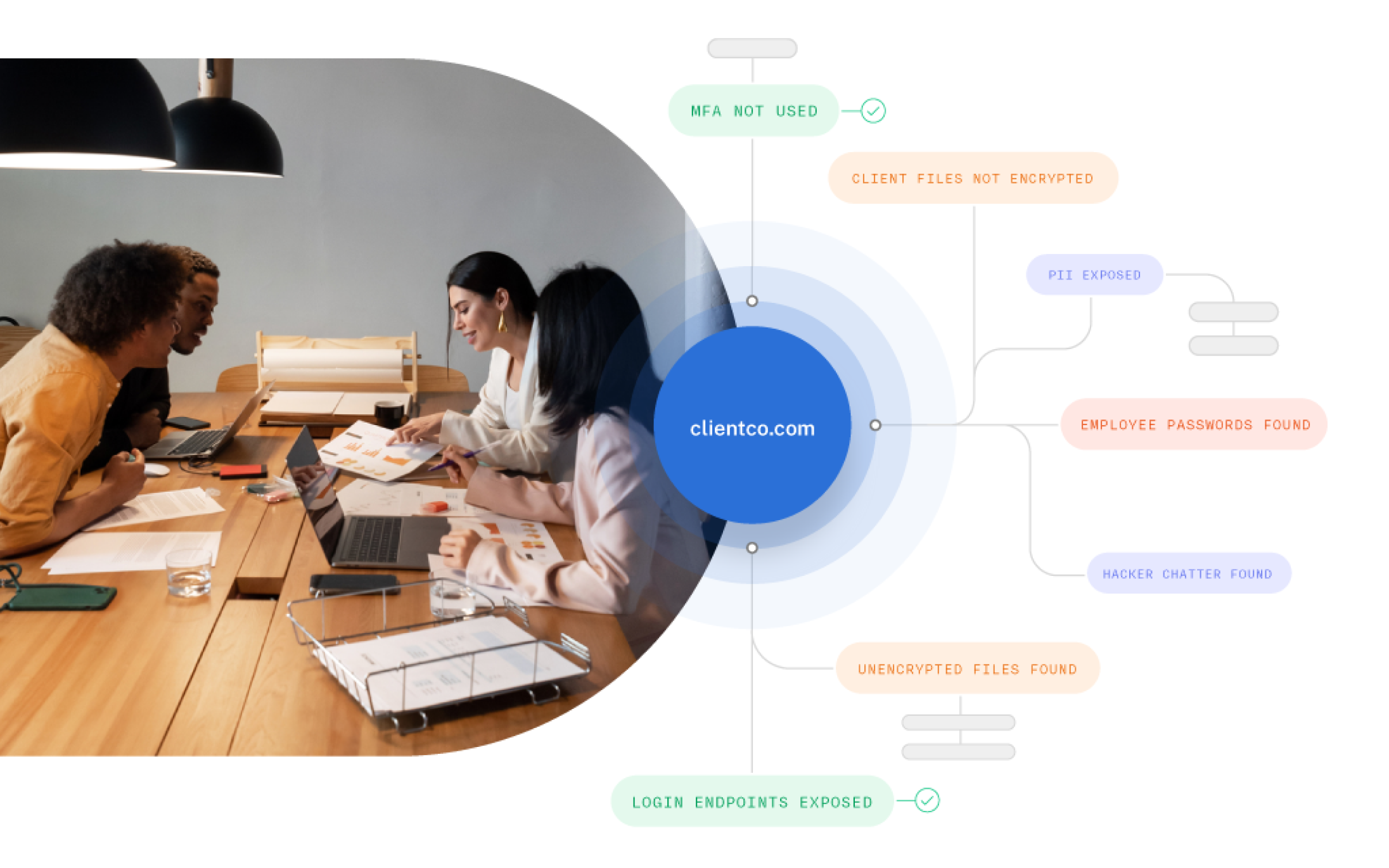

ACTIVE PROTECTION

Detect and mitigate risks before they strike

✓ Continuous monitoring and alerting of risks ✓ Cyber security experts to help patch vulnerabilities ✓ Monitoring for vendor and supply chain cyber risk

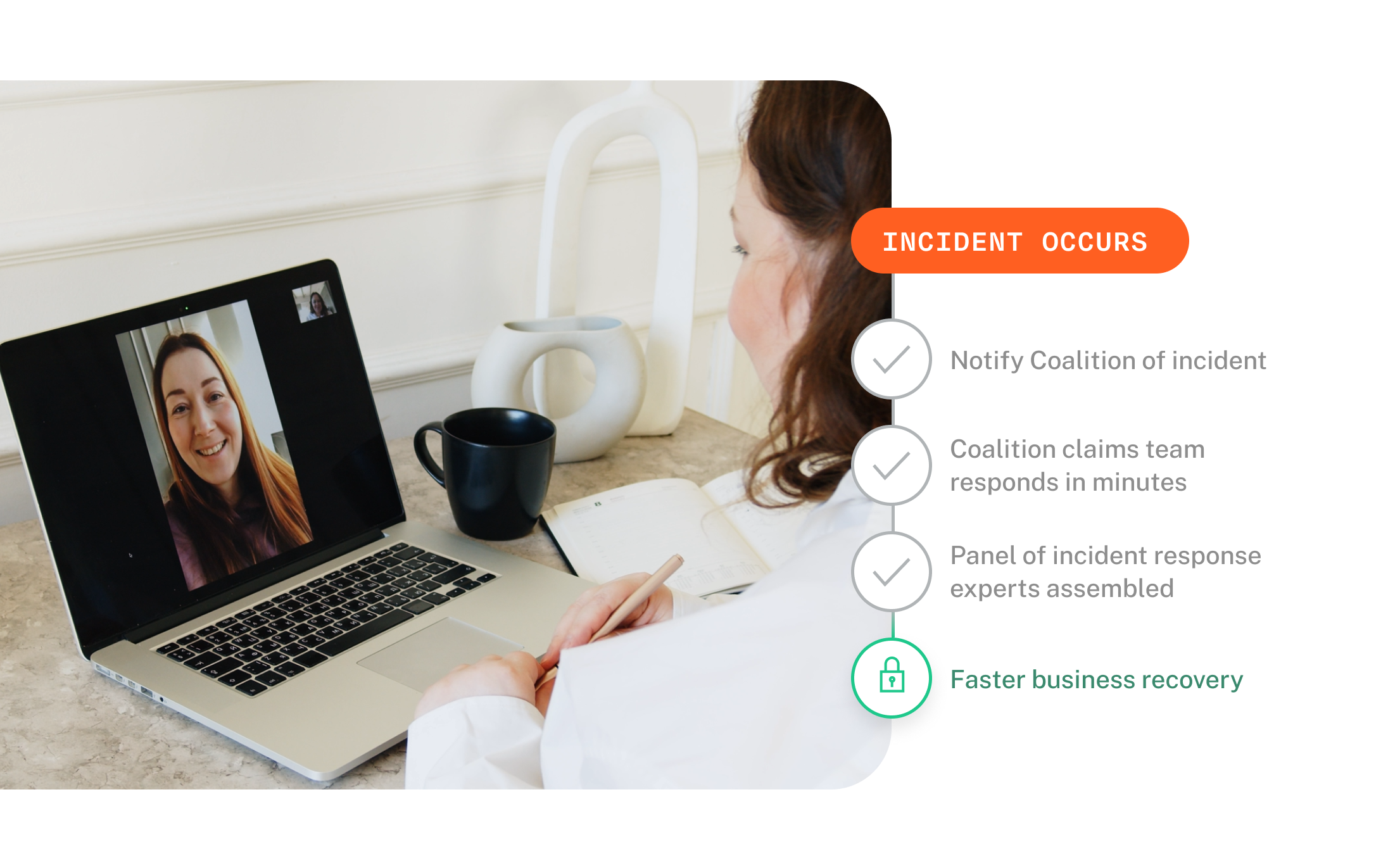

ACTIVE RESPONSE

Get back to business faster with help from our expert team

✔ Benefit from a dedicated incident team ✔ 24/7 claims support and response

✔ Cyber insurance underwritten by leading global insurers

COVERAGES

Comprehensive cyber insurance for business

Built by insurance pros with cyber expertise, made for digital risks.

Active Cyber Insurance

Manage and mitigate cyber risk with insurance coverage, active monitoring, and access to incident response experts to help protect your business before, during, and after an incident.

Active Tech E&O

Comprehensive errors and omissions coverage to reimburse a business for claims arising from performing technology services or providing products.

FTF RECOVERY

Recovery tactics to help get back stolen funds

If you experience financial fraud, losses can pile up quickly. Coalition has successfully recovered fraudulent funds transfers for many policyholders.

5 min

average response time from the claims team**

47%

of incidents resolved at no additional cost to the policyholder in 2022*

$30M

of fraudulently transferred funds were successfully recovered by Coalition in 2023*

Coalition seeks the maximum recovery across industries

Cyber threats don’t discriminate—and neither does our protection. Coalition provides cyber coverage options and support to meet your specific cybersecurity needs.

Backed by the world’s leading reinsurers

Give your clients comprehensive cyber insurance coverage backed by the financial strength of the world’s leading insurance providers.

£1B

Coalition offers coverage for organizations with up to $5B in revenue

75K

Policyholders globally—and counting

1st

Active Insurance provider designed to prevent digital risk before it strikes

4

countries Coalition serves: US, UK, AUS, CAN